Discover Wyoming Credit Unions: Comprehensive Financial Services Near You

Why You Need To Choose Lending Institution for Financial Security

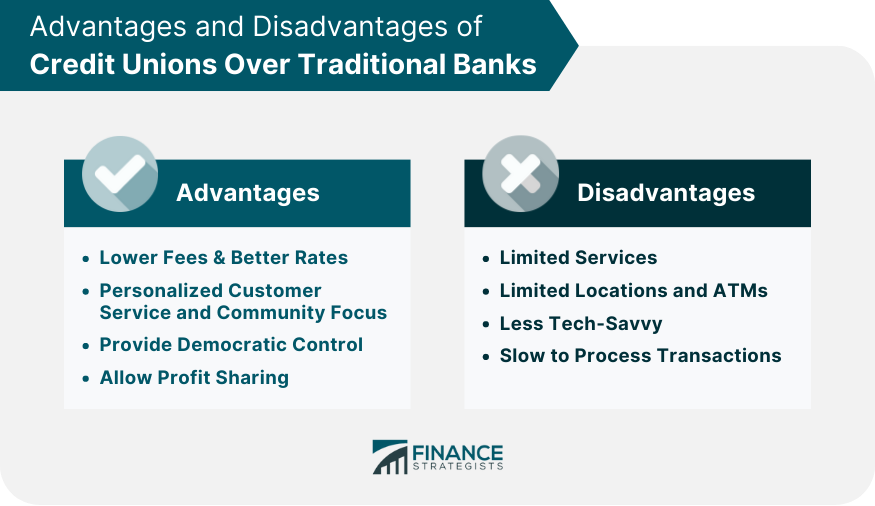

Lending institution stand as columns of economic security for several people and areas, using a special technique to financial that prioritizes their members' well-being. Their commitment to lower costs, affordable prices, and customized customer care establishes them besides standard banks. There's even more to credit report unions than just financial rewards; they likewise promote a feeling of neighborhood and empowerment among their participants. By selecting credit history unions, you not only safeguard your monetary future but additionally enter into an encouraging network that values your monetary success.

Reduced Fees and Affordable Prices

Cooperative credit union frequently supply lower charges and affordable rates compared to typical banks, supplying customers with a more economically secure option for managing their financial resources. Among the key advantages of cooperative credit union is their not-for-profit structure, enabling them to focus on participant benefits over optimizing earnings. This difference in focus allows credit score unions to offer lower charges for services such as inspecting accounts, interest-bearing accounts, and lendings. Furthermore, cooperative credit union typically offer much more competitive rates of interest on savings accounts and lendings, equating to much better returns for members and lower borrowing costs.

Personalized Customer Solution

Supplying tailored assistance and customized remedies, lending institution focus on customized customer support to fulfill participants' certain financial needs efficiently. Unlike traditional banks, lending institution are known for growing a much more individual connection with their members. This customized method entails comprehending each member's special financial scenario, goals, and choices. Cooperative credit union staff usually make the effort to listen attentively to participants' issues and give customized referrals based on their private demands.

One trick facet of personalized client service at cooperative credit union is the concentrate on monetary education. Lending institution representatives are dedicated to helping members comprehend different monetary items and solutions, encouraging them to make informed decisions (Credit Union in Cheyenne Wyoming). Whether a member is seeking to open up an interest-bearing account, use for a loan, or plan for retirement, cooperative credit union provide customized assistance every step of the way

Moreover, credit history unions typically go the additional mile to guarantee that their members really feel valued and sustained. By developing strong relationships and cultivating a feeling of neighborhood, cooperative credit union produce an inviting environment where participants can rely on that their monetary well-being remains in great hands.

Strong Area Emphasis

With a commitment to sustaining and fostering neighborhood links community campaigns, lending institution focus on a strong area focus in their procedures - Credit Union Cheyenne. Unlike standard banks, credit unions are member-owned monetary institutions that run for the benefit of their participants and the communities they offer. This unique framework allows cooperative credit union to focus on the health of their members and the neighborhood community instead of only on producing earnings for outside investors

Lending institution typically take part in various neighborhood outreach programs, sponsor neighborhood events, and work together with various other companies to deal with neighborhood demands. By buying the Click This Link area, lending institution aid boost local economic situations, produce task possibilities, and enhance overall lifestyle for Recommended Reading residents. Additionally, credit score unions are understood for their involvement in monetary literacy programs, supplying instructional resources and workshops to assist area participants make educated monetary choices.

Financial Education And Learning and Help

In promoting monetary proficiency and supplying assistance to individuals in need, credit score unions play a crucial role in equipping neighborhoods in the direction of financial security. One of the vital advantages of credit rating unions is their focus on offering monetary education to their members.

Furthermore, cooperative credit union often provide assistance to members facing monetary problems. Whether it's via low-interest fundings, adaptable settlement strategies, or monetary counseling, cooperative credit union are devoted to assisting their members conquer challenges and achieve financial security. This individualized technique collections cooperative credit union in addition to typical financial institutions, as they prioritize the financial wellness of their participants above all else.

Member-Driven Choice Making

Members of lending institution have the possibility to articulate their point of views, give responses, and also compete placements on the board of supervisors. This degree of interaction promotes a sense of possession and area amongst the members, as they have a direct influence on the direction and plans of the cooperative credit union. By actively entailing participants in decision-making, debt unions can much better customize their services to meet the unique demands of their area.

Eventually, member-driven decision making not only boosts the general member experience yet additionally promotes transparency, trust fund, and liability within the lending institution. It showcases the cooperative nature of cooperative credit union and their commitment to offering the finest interests of their participants.

Conclusion

Finally, credit unions use a compelling selection for monetary security. With lower costs, competitive prices, customized client service, a solid neighborhood emphasis, and a commitment to monetary education and aid, cooperative credit union prioritize participant advantages and empowerment. With member-driven decision-making procedures, credit history unions advertise transparency and liability, guaranteeing a steady financial future for their members.

Credit unions stand as pillars of economic security for numerous people and areas, providing a special approach to banking that prioritizes their participants' health. YOURURL.com Unlike traditional banks, credit unions are member-owned financial organizations that run for the advantage of their members and the communities they serve. Furthermore, credit unions are known for their involvement in monetary proficiency programs, supplying instructional resources and workshops to help community members make notified monetary choices.

Whether it's via low-interest loans, flexible repayment plans, or financial counseling, credit history unions are devoted to assisting their participants overcome obstacles and accomplish financial stability. With lower costs, competitive prices, customized client service, a strong community focus, and a commitment to financial education and learning and aid, credit history unions prioritize member benefits and empowerment.